The remote work revolution has created incredible opportunities for job seekers worldwide. Unfortunately, it has also created a hunting ground for scammers who prey on eager applicants desperate for legitimate work-from-home opportunities. Remote job scams cost victims an average of $2,000 each, according to the Federal Trade Commission, with some losing their entire savings to sophisticated fraud schemes.

These aren’t obvious Nigerian prince emails anymore. Modern work from home scams use professional-looking websites, stolen company logos, and carefully crafted job descriptions that mirror legitimate postings. Scammers research real companies, copy actual job requirements, and create convincing narratives that fool even experienced job seekers.

The stakes couldn’t be higher. Beyond financial loss, job scam victims often suffer identity theft, damaged credit, and the emotional trauma of realizing they’ve been manipulated during a vulnerable time in their career. The psychological impact can be devastating—many victims become so paranoid about job scam red flags that they avoid legitimate opportunities entirely.

This guide is your shield against these predators. You’ll learn to identify the subtle warning signs that separate real opportunities from elaborate cons, master a simple three-step verification process that protects you from fraud, and know exactly what to do if you’ve already been targeted.

The good news? Once you understand their tactics, scammers become remarkably easy to spot. Their schemes rely on urgency, desperation, and ignorance of red flags. Knowledge is your best defense, and by the end of this article, you’ll have the tools to navigate the remote job market with confidence rather than fear.

💡 Starting Your Remote Job Search? This safety guide assumes you’re actively applying for remote positions. If you’re just beginning to explore work-from-home opportunities, start with our comprehensive Remote Jobs No Experience: Your Definitive 2025 Guide to understand the legitimate opportunities available, then return here to protect yourself from scams.

Applying for Remote Jobs Safely: Your Must-Read Guide

As you start applying for the jobs in our definitive guide, it’s crucial to stay safe. Scammers specifically target eager job seekers who are excited about remote work opportunities and may overlook warning signs in their enthusiasm to escape traditional employment constraints.

Why Remote Job Seekers Are Prime Targets:

Remote job applications typically involve more digital communication and less face-to-face interaction than traditional hiring processes. This creates opportunities for scammers to hide behind fake identities and professional-looking email addresses. Additionally, the promise of working from home appeals to people in desperate financial situations who may be more willing to overlook red flags.

The Evolving Threat Landscape:

Today’s job scammers are sophisticated operators who understand the remote work industry. They post fake jobs on legitimate job boards, create professional websites, and even conduct phone or video interviews to build credibility. Some scams involve weeks of communication and fake “training” before revealing their true purpose.

Your Vulnerability Points:

The most dangerous moments in your job search are:

- When you’re excited about a promising opportunity

- When you’re facing financial pressure to find work quickly

- When you’re unfamiliar with standard remote work hiring practices

- When communication happens exclusively through email or text

The Protection Mindset:

Successful job scam prevention requires balancing optimism with healthy skepticism. Every opportunity deserves verification, regardless of how professional it appears or how desperately you need work. The few minutes spent checking red flags can save you thousands of dollars and months of recovery time.

This guide is your shield. We will show you the exact red flags to look for and provide a simple verification process so you can apply with confidence while avoiding the financial and emotional devastation that job scams create.

The Scammer’s Playbook: Real Examples of Fake Job Postings

Understanding scammer tactics requires seeing actual examples of their work. These real-world case studies reveal the specific techniques fraudsters use to appear legitimate while hiding their true intentions.

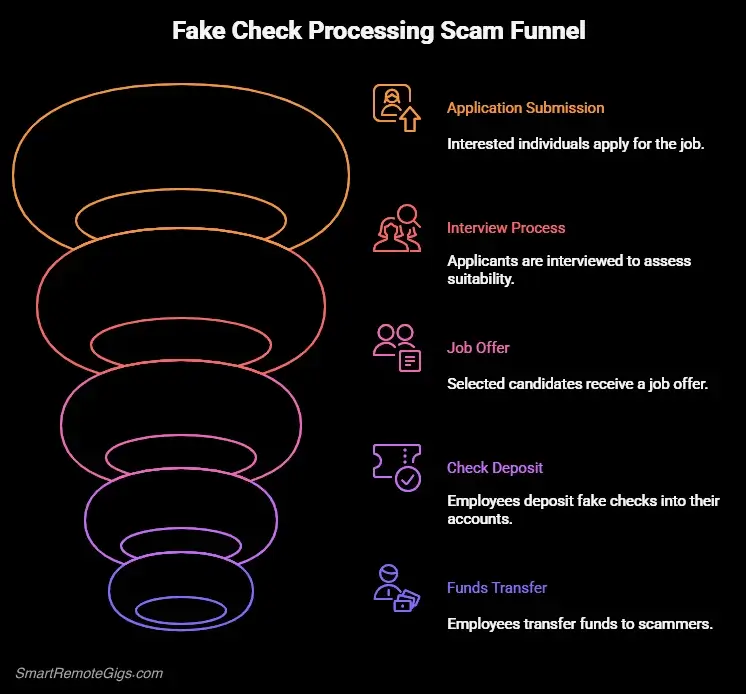

Case Study 1: The Fake Check Processing Scam

URGENT: Remote Payment Processor Needed

Company: MidWest Financial Solutions

Salary: $4,200/month part-time

Location: Work from home

We are seeking a reliable individual to process payments for our international clients.

This is a legitimate work-from-home opportunity with excellent pay and flexible hours.

Responsibilities:

- Receive payments from clients

- Process deposits to company accounts

- Maintain accurate transaction records

- Communicate with international partners

Requirements:

- Must have active bank account

- Reliable internet connection

- Basic computer skills

- Available to start immediately

Contact: [email protected]

Apply today! Training provided!Red Flags Identified:

- Generic Gmail address: Legitimate companies use branded email addresses (@companyname.com)

- Unrealistic salary: $4,200/month part-time equals $25+ per hour for basic data entry

- Vague job description: “Process payments” doesn’t explain actual work activities

- Immediate start requirement: Legitimate hiring involves background checks and onboarding

- Bank account requirement: No legitimate employer needs your banking information upfront

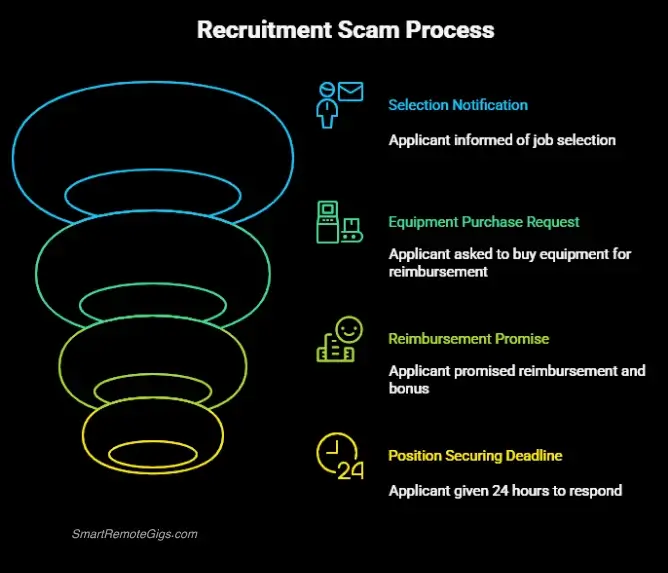

Case Study 2: The Equipment Purchase Scam

Subject: Congratulations! You've Been Selected for Remote Data Entry Position

Dear Applicant,

We are pleased to inform you that you have been selected for our remote data entry specialist position with TechGlobal Industries. Your resume impressed our hiring team.

Position Details:

- Starting salary: $3,800/month

- Full benefits package

- Equipment provided by company

- Immediate start date available

Next Steps:

To begin your employment, you will need to purchase specialized software and equipment totaling $299. This will be reimbursed on your first paycheck along with a $500 signing bonus.

Please respond within 24 hours to secure your position.

Best regards,

Sarah Johnson, HR Manager

TechGlobal Industries

[email protected]Red Flags Identified:

- Upfront payment required: Legitimate employers never require employees to pay for equipment or training

- Pressure tactics: “24 hours to secure your position” creates artificial urgency

- Yahoo email address: Professional companies use branded email domains

- Too good to be true: High salary plus benefits plus signing bonus for entry-level work

- No interview process: Real companies interview candidates before making offers

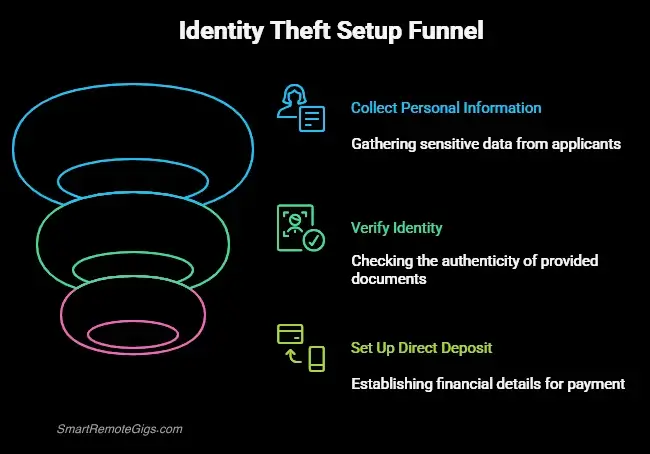

Case Study 3: The Identity Theft Setup

Remote Customer Service Representative

GlobalTech Solutions - $22/hour

We're hiring immediately for remote customer service positions. No experience necessary!

Application Requirements:

Please provide the following information to process your application:

- Full legal name and address

- Social Security Number

- Driver's license number

- Bank account details (for direct deposit setup)

- Copy of driver's license or passport

We will contact qualified candidates within 48 hours.

Apply now: [email protected]Red Flags Identified:

- Sensitive information requested upfront: SSN and bank details should only be provided after accepting a verified job offer

- Unprofessional email structure: Legitimate companies don’t use outlook.com for official communication

- No company verification: No phone number, physical address, or website provided

- Immediate hire promise: “No experience necessary” plus immediate hiring signals desperation to collect data

- Identity document requests: Driver’s license copies should only be provided for verified background checks

These examples reveal consistent patterns: unrealistic compensation, unprofessional communication, upfront payment requirements, and requests for sensitive personal information before legitimate employment verification.

The 7 Deadly Sins: An Unmistakable Red Flag Checklist

When evaluating any remote job opportunity, these seven warning signs should immediately trigger your skepticism. Even one of these red flags warrants additional investigation; multiple red flags indicate certain fraud.

1. They Ask YOU for Money (Training, Equipment, Background Checks)

The Scam: Legitimate employers pay for all business expenses, including training, equipment, software licenses, and background checks. Any request for upfront payment indicates fraud.

Common Cover Stories:

- “Refundable training deposit”

- “Equipment purchase (reimbursed later)”

- “Background check processing fee”

- “Software licensing costs”

The Reality: Real companies budget for employee expenses and never require workers to pay business costs. If they need you to pay for anything, they’re not a real employer.

2. They Send YOU a Check to Deposit (The #1 Sign of Fake Check Scam)

The Scam: Scammers send checks for “equipment purchases,” “first paycheck,” or “client payments” and ask you to deposit them and wire money elsewhere. The checks are fake, but banks may make funds available before discovering the fraud.

How It Works:

- You receive a legitimate-looking check for $2,000-$5,000

- Instructions tell you to deposit it and wire $1,500 to a “vendor” for equipment

- You keep the remaining $500 as your first week’s pay

- Days later, the bank discovers the check is fake and you owe the full amount

The Warning: Any job involving check processing, payment forwarding, or money transfers is a scam. Legitimate employers use direct deposit and handle their own vendor payments.

3. The Job Offer Is Instant (No Real Interview Process)

The Scam: Professional hiring involves multiple steps: application review, phone screening, interviews, reference checks, and background verification. Instant offers skip these safeguards because scammers need to move quickly.

Legitimate Hiring Timeline:

- Application submission

- Initial screening (phone/email)

- One or more interviews

- Reference and background checks

- Official offer with written terms

Red Flag Phrases:

- “You’re hired! Start immediately!”

- “Congratulations! You’ve been selected!”

- “No interview necessary”

- “Start earning today!”

4. Communication Is Unprofessional (Typos, Grammar, Formatting)

The Scam: Professional companies have standards for written communication. Multiple spelling errors, poor grammar, inconsistent formatting, or unprofessional language indicate either fraud or a company you don’t want to work for.

Warning Signs:

- Multiple spelling and grammatical errors

- Inconsistent company name spelling

- ALL CAPS or excessive exclamation points

- Generic greetings (“Dear Job Seeker”)

- Poor email formatting or layout

Professional Standard: Legitimate employers proofread important communications and maintain consistent branding across all materials.

5. They Ask for Sensitive Data (SSN, Bank Info) Before an Offer

The Scam: Social Security Numbers, bank account details, and copies of identification documents should only be requested after you’ve accepted a verified job offer from a legitimate company.

Appropriate Timing for Sensitive Information:

- After job offer acceptance: SSN for background check and tax forms

- After employment verification: Bank details for direct deposit setup

- After identity confirmation: ID copies for I-9 employment eligibility verification

Immediate Red Flags:

- SSN requested in initial application

- Bank account “for direct deposit setup” before hiring

- Driver’s license copy for “verification purposes”

- Credit report authorization before job offer

6. The Company Has No Professional Online Footprint

The Scam: Legitimate businesses maintain professional websites, social media presence, and verifiable contact information. Companies with no online presence or suspicious digital footprints are likely fabricated.

Verification Checklist:

- Professional website with company information

- Physical business address (not PO Box)

- Working phone number with professional voicemail

- LinkedIn company page with real employees

- Positive reviews and industry recognition

Red Flags:

- Website created recently (check domain registration date)

- No employee profiles on LinkedIn

- Physical address leads to residential location

- Phone number goes to generic voicemail

- No online reviews or mentions

7. It Sounds Too Good to Be True (Unrealistic Compensation/Benefits)

The Scam: Scammers use unrealistic compensation to overcome skepticism about other red flags. If the salary, benefits, or working conditions seem impossibly good for your experience level, investigate thoroughly.

Reality Check Questions:

- Does the salary align with industry standards for this role?

- Are the benefits package realistic for a company this size?

- Do the work requirements match the compensation level?

- Would a legitimate company really offer this to someone with my experience?

Common “Too Good” Red Flags:

- $25+ per hour for basic data entry

- Full benefits for part-time work

- Large signing bonuses for entry-level positions

- Guaranteed income regardless of performance

- “Work 2 hours, earn $500” promises

⚠️ Data Entry Job Warning: Data entry positions are particularly targeted by scammers due to their appeal to beginners. Before applying for any data entry opportunity, review our Data Entry Jobs Guide to understand legitimate job requirements and typical compensation ranges.

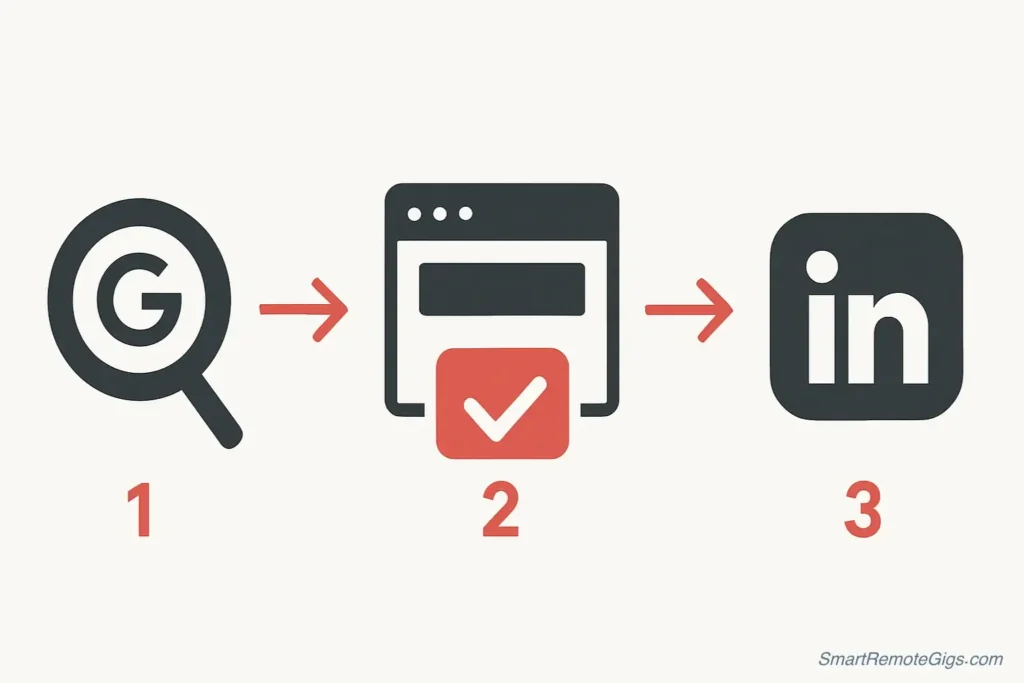

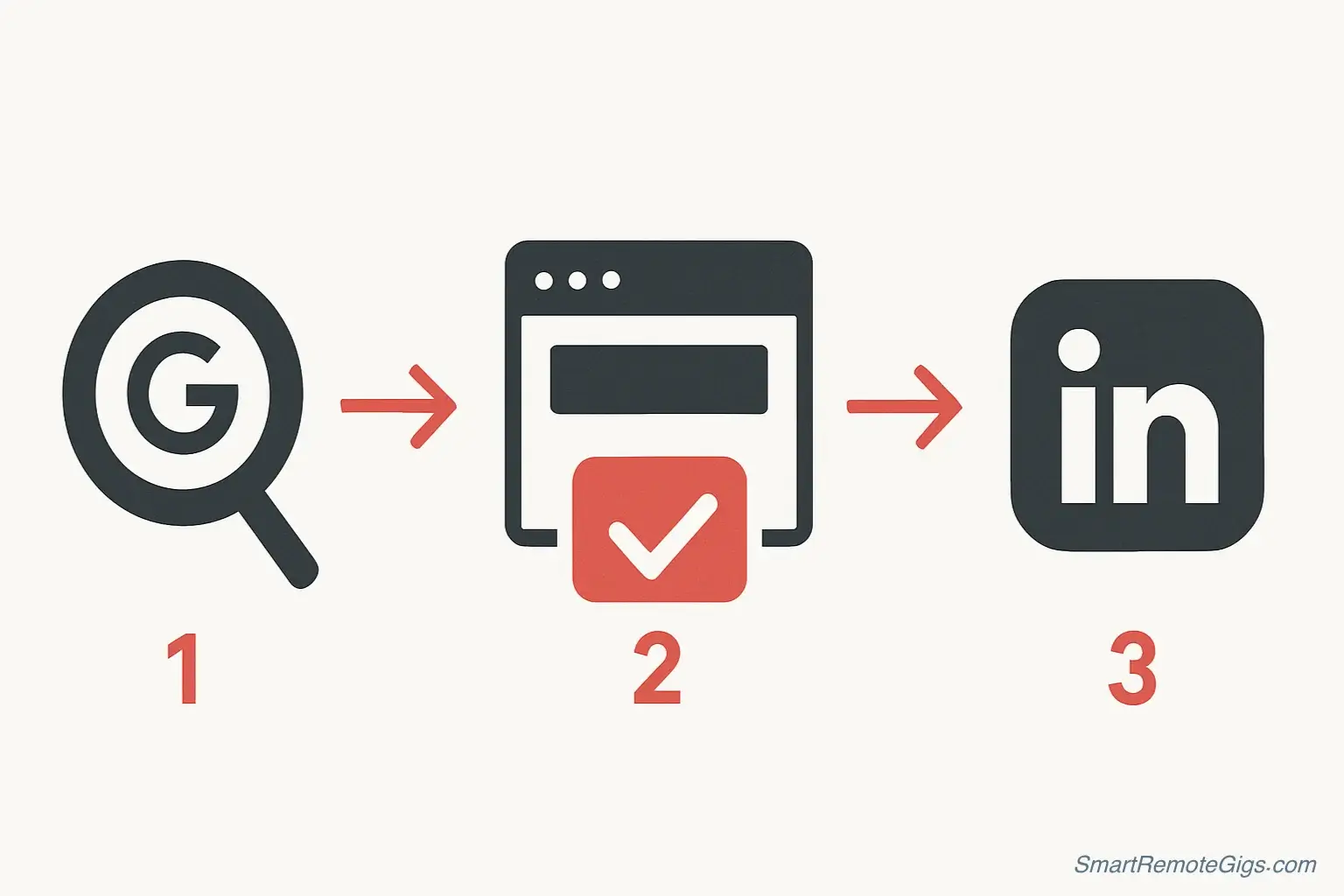

The 3-Step Verification Process: How to Vet Any Company

This simple verification protocol takes 10-15 minutes but can save you thousands of dollars and weeks of recovery time. Use this process for every opportunity before providing personal information or investing significant time in applications.

Step 1: Google the Company Name + “Scam” or “Reviews”

The Process:

Search for “[Company Name] scam,” “[Company Name] reviews,” and “[Company Name] complaints” to see what other job seekers have experienced.

What to Look For:

- Positive Signal: Professional reviews on sites like Glassdoor, Indeed, or industry publications

- Warning Signs: Multiple scam reports, complaints about fake checks, or warnings from other job seekers

- Red Flags: No search results at all, or only results from the past few weeks

Advanced Search Techniques:

- Use quotation marks around the exact company name for precise results

- Check multiple search engines (Google, Bing, DuckDuckGo) for comprehensive coverage

- Look at the dates of reviews—clusters of positive reviews from the same time period may indicate fake testimonials

Search Examples:

"TechGlobal Industries" scam

"MidWest Financial Solutions" reviews

"GlobalTech Solutions" complaints

"[Company Name]" fake job postingStep 2: Verify the Website and Email Address

Website Verification:

- Domain Check: Does the email domain match the company website? ([email protected] should match www.companyname.com)

- Professional Quality: Is the website professionally designed with complete company information?

- Contact Information: Are there multiple contact methods (phone, address, email) that you can verify?

- Recent Creation: Use WHOIS lookup tools to check when the domain was registered—recent creation dates are suspicious

Email Address Red Flags:

- Generic providers (Gmail, Yahoo, Hotmail, Outlook) for official company communication

- Misspelled company names in email addresses

- Numbers or random characters in professional email addresses

- Email addresses that don’t match the company’s claimed name

Website Quality Indicators:

- Professional design and layout

- Complete “About Us” and “Contact” pages

- Detailed company history and leadership information

- Industry certifications or accreditations

- News or press releases section

Step 3: Check LinkedIn for Real Company Presence

LinkedIn Verification Process:

- Search for the company page on LinkedIn

- Verify employee count matches the company’s claims about size

- Review employee profiles to confirm real people work there

- Check the person who contacted you to see if they actually work for the company

- Examine posting history to see if the company regularly shares industry content

LinkedIn Red Flags:

- No company page exists: Legitimate businesses maintain LinkedIn presence

- Recently created page: Company pages created in the past few months are suspicious

- No employee profiles: Real companies have employees who list them as current employers

- Inconsistent information: Company size, location, or industry doesn’t match other sources

- Generic stock photos: Professional headshots for all “employees” may indicate fake profiles

Employee Verification:

- Profile completeness: Real employees have detailed work histories and connections

- Professional network: Legitimate employees connect with industry colleagues

- Activity history: Real professionals share industry content and engage with posts

- Photo authenticity: Reverse image search suspicious profile photos

Advanced LinkedIn Tactics:

- Check if other employees from the company have posted about job openings

- Look for news or updates about the company in employee activity feeds

- Verify that leadership profiles match company website executive information

- Search for the company name in LinkedIn posts to see organic mentions

Documentation Process:

Keep records of your verification results in case you need to report fraudulent activity later. Screenshot suspicious communications, note dates of interactions, and save copies of fake job postings.

🔍 Need More Technical Help? If you’re struggling with online verification tools, website analysis, or digital research techniques, check out our Remote Work Tech Support Guide for comprehensive tutorials on protecting yourself online.

What to Do If You’ve Been Scammed

If you’ve already fallen victim to a job scam, immediate action can limit the damage and help authorities track down the perpetrators. Time is critical—the sooner you respond, the better your chances of recovery and prevention of further harm.

Step 1: Cease All Communication Immediately

Stop All Contact:

- Do not respond to emails, texts, or phone calls from the scammer

- Block all phone numbers and email addresses associated with the fake company

- Do not provide any additional personal information, regardless of threats or promises

- Save all communication records for evidence

Avoid Common Mistakes:

- Don’t try to “get your money back” by continuing engagement

- Don’t threaten the scammer, as this may escalate their tactics

- Don’t believe promises that they’ll return your money if you pay additional fees

- Don’t feel embarrassed—scammers are professionals who fool educated people daily

Step 2: Contact Your Bank Immediately

If You’ve Shared Financial Information:

- Call your bank’s fraud department using the number on your debit/credit card

- Report all suspicious transactions and request account monitoring

- Consider closing compromised accounts and opening new ones

- Request new debit/credit cards with different numbers

If You’ve Deposited Fake Checks:

- Inform your bank immediately about the fraudulent deposit

- Prepare to repay the full amount of the fake check

- Understand that you’re responsible for money withdrawn against fake deposits

- Document all conversations with bank representatives

Credit Protection Steps:

- Place fraud alerts on your credit reports with all three bureaus (Experian, Equifax, TransUnion)

- Consider credit freezes to prevent new accounts from being opened

- Monitor your credit reports closely for unauthorized activity

- Document any credit-related damage for potential recovery efforts

Step 3: Report the Scam to Authorities

Federal Trade Commission (FTC):

Report job scams at ReportFraud.ftc.gov to help authorities track fraudulent activity and warn other consumers.

Required Information for FTC Report:

- Company name and contact information used by scammer

- Names of individuals who contacted you

- Copies of all communication (emails, texts, job postings)

- Details of money lost or personal information shared

- Timeline of interactions

Better Business Bureau (BBB):

File complaints at BBB Scam Tracker to help other job seekers avoid the same fraudulent companies.

Job Board Reporting:

Contact the job board where you found the posting to report fraudulent listings:

- Indeed: Use their “Report Job” feature on the original posting

- LinkedIn: Report fake job postings through their fraud reporting system

- ZipRecruiter: Contact their support team with scam details

- Monster: Use their fraud reporting tools

Local Law Enforcement:

File a police report if you’ve lost money or had identity theft, especially if the scammer has your Social Security Number or bank account information.

State Attorney General:

Many states have consumer protection divisions that investigate job scams and can provide additional resources for recovery.

Documentation for All Reports:

- Save screenshots of fake job postings before they’re removed

- Keep copies of all email and text communication

- Document phone numbers and names used by scammers

- Record timeline of interactions and money lost

- Note any personal information that was compromised

Follow-Up Actions:

- Keep reference numbers from all reports filed

- Follow up with authorities if you discover additional fraudulent activity

- Share your experience on job search forums to warn other seekers

- Consider consulting with identity theft recovery services if significant personal information was compromised

Conclusion: Job Search with Confidence, Not Fear

The remote work revolution has created unprecedented opportunities for skilled professionals to build careers without geographic limitations. While job scammers prey on the excitement and desperation of eager job seekers, knowledge and preparation make you an extremely difficult target.

Your Protection Summary:

You now recognize the seven deadly sins that reveal fraudulent opportunities, understand the three-step verification process that protects you from sophisticated scams, and know exactly what to do if you’ve already been targeted. These tools transform you from vulnerable prey into an informed consumer who can navigate the remote job market safely.

The Reality of Remote Job Scams:

Despite the attention scams receive, the vast majority of remote job opportunities are legitimate. Companies worldwide are genuinely hiring remote workers and building distributed teams. Scammers represent a small but vocal minority that preys on job seekers who don’t understand the warning signs.

Balancing Caution with Opportunity:

Successful remote job searching requires healthy skepticism without paralyzing paranoia. Verification takes minutes but protects against months of recovery time. The investment in safety checks is minimal compared to the potential cost of falling victim to fraud.

Trust Your Instincts:

If something feels wrong about a job opportunity, investigate further. Legitimate employers understand that professional job seekers perform due diligence and welcome questions about company verification. Companies that pressure you to skip safety checks or provide personal information immediately are revealing their fraudulent nature.

Building Long-Term Safety Habits:

- Always verify companies before providing personal information

- Never pay upfront costs for job opportunities

- Research typical compensation ranges for positions you’re considering

- Maintain professional skepticism throughout the hiring process

- Report suspicious activity to protect other job seekers

The Path Forward:

Your awareness of these tactics makes you a difficult target for scammers while positioning you to recognize legitimate opportunities quickly. The remote work market offers genuine career advancement for prepared professionals who understand how to separate real opportunities from elaborate cons.

Start your job search with confidence. You have the knowledge to protect yourself from fraud while pursuing the remote career opportunities that can transform your professional life. The vast majority of remote employers are legitimate companies seeking skilled professionals exactly like you.

🚀 Ready to Start Your Safe Job Search? Now that you’re protected from scams, return to our comprehensive Remote Jobs No Experience: Your Definitive 2025 Guide to discover legitimate opportunities and proven application strategies that help you land your ideal remote position safely.

Knowing how to spot scams is crucial. The next step is finding legitimate openings. Our guide to the best part-time remote jobs only features roles from trusted fields.

This guide provides a step-by-step framework to spot and avoid remote job scams. Learn the 7 “deadly sins” that signal fraud, a 3-step verification process to vet any company, and what to do if you’ve been scammed.

Total Time: 15 minutes

Learn the 7 “Deadly Sins” of Job Scams

Familiarize yourself with the unmistakable red flags. These include any request for you to pay money, receiving a check to deposit, an instant job offer with no real interview, unprofessional communication, and requests for sensitive data before a formal offer.

Follow the 3-Step Verification Process for Every Opportunity

Vet any company before you apply. First, Google the company name + “scam” or “reviews.” Second, verify that the company’s website and email address are professional and match. Third, check for a real company presence on LinkedIn with legitimate employee profiles.

Know What to Do If You’ve Been Scammed

If you’ve fallen victim, act immediately. Cease all communication with the scammer. Contact your bank’s fraud department to report suspicious transactions and protect your accounts. Report the scam to authorities like the Federal Trade Commission (FTC).

Build Long-Term Safety Habits

Adopt a mindset of healthy skepticism. Always verify companies, never pay for job opportunities, research typical compensation for your roles, and report any suspicious activity to protect other job seekers.

Tools:

- Google search

- A WHOIS lookup tool

- The Federal Trade Commission (FTC) reporting website