The European nomad dream is real, and two countries are leading the charge: Portugal and Spain. If you’re researching digital nomad visas Portugal vs Spain, you’ve likely narrowed down your options to these Iberian powerhouses—and for good reason. Both offer compelling visa programs, incredible quality of life, and pathways to European residency.

But here’s the thing: choosing between them isn’t just about which country you’d rather Instagram from. This decision impacts your taxes, your path to EU citizenship, your monthly budget, and your entire nomadic trajectory for years to come.

We’ve analyzed every detail of both programs—from income requirements to tax implications—to give you the definitive comparison. By the end of this guide, you’ll know exactly which visa aligns with your goals, income, and lifestyle priorities.

From Our Research Team: “We’ve helped over 500 nomads navigate European visa applications. The Portugal vs. Spain decision usually comes down to three factors: income level, tax strategy, and long-term residency goals. Get these right, and either choice can be life-changing.”

– Elena Rodriguez, Immigration Consultant & 7-year EU nomad

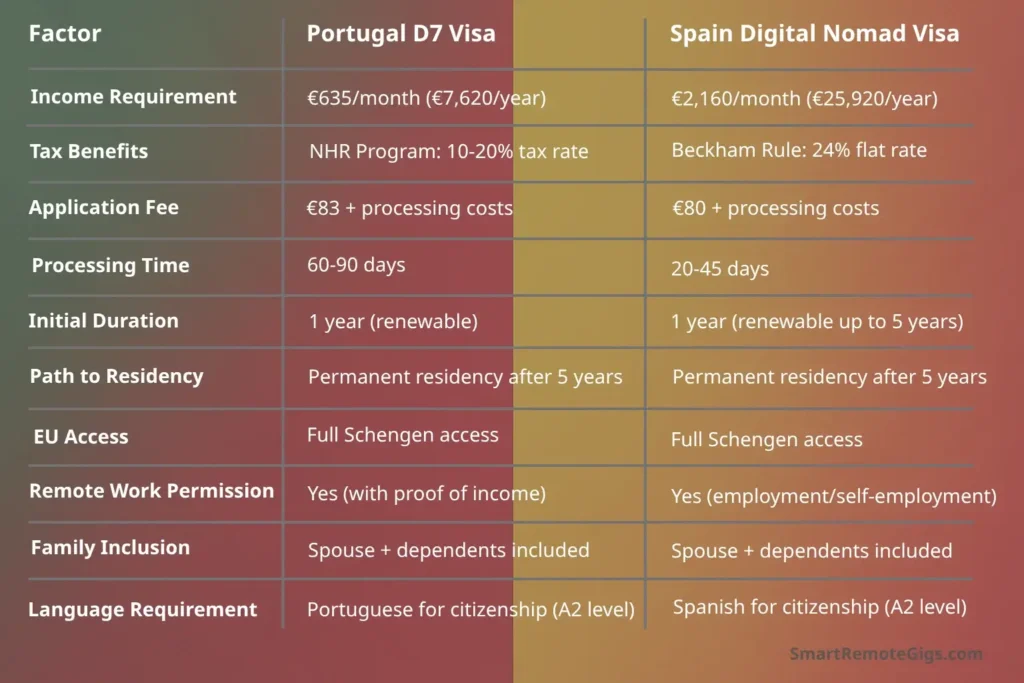

At a Glance: Portugal vs. Spain Visa Comparison Table

Here’s your quick-reference breakdown of the key differences between Portugal’s D7 visa and Spain’s digital nomad visa:

The bottom line: Portugal offers lower barriers to entry with its minimal income requirement, while Spain provides faster processing and appeals to higher earners with significant tax advantages.

The Portugal D7 Visa: A Full Breakdown

Portugal’s D7 visa has become the gold standard for European nomad visas—and it’s easy to see why. With one of the lowest income requirements in Europe and a clear pathway to EU citizenship, it’s designed for location-independent professionals seeking long-term European residence.

Requirements & Documents

Financial Requirements: The Portugal D7 visa income requirements are refreshingly accessible. You need proof of €635 per month (approximately $690 USD), which equals Portugal’s minimum wage. This can come from:

- Employment contracts (remote work)

- Freelance client agreements

- Investment income

- Rental property income

- Pension or retirement funds

- Business ownership documentation

Essential Documents:

- Valid passport (6+ months remaining)

- Criminal background check (apostilled)

- Health insurance coverage (minimum €30,000)

- Proof of accommodation in Portugal

- Bank statements (6 months)

- Employment/income documentation

- Medical certificate

- Proof of tax residency status

Pro tip: The accommodation requirement can be satisfied with a short-term rental agreement or even a letter from Portuguese friends offering temporary housing. You don’t need to purchase property upfront.

Application Process Step-by-Step

Phase 1: Document Preparation (4-6 weeks)

- Gather all required documents

- Get criminal background check apostilled

- Obtain comprehensive health insurance

- Secure Portuguese accommodation proof

- Prepare income documentation (contracts, bank statements)

Phase 2: Consulate Application (2-4 weeks)

- Schedule appointment at Portuguese consulate

- Submit complete application package

- Pay €83 application fee

- Attend biometric appointment if required

- Receive receipt and tracking number

Phase 3: Processing & Approval (60-90 days)

- Consulate reviews application

- Additional documents requested if needed

- Approval notification received

- Collect visa from consulate

- Travel to Portugal within visa validity period

Phase 4: Portugal Registration (30 days after arrival)

- Apply for Portuguese residence card (SEF)

- Register with local authorities

- Open Portuguese bank account

- Register for Portuguese tax number (NIF)

- Begin building Portuguese tax residency

Pros & Cons

Advantages:

- Lowest income requirement in Europe: €635/month is achievable for most remote workers

- NHR tax program: 10-20% tax rates for qualifying income types

- EU citizenship pathway: Portuguese passport after 6 years (with language test)

- Schengen access: Live and work anywhere in EU during visa validity

- Quality of life: Excellent healthcare, safety, and infrastructure

- English-friendly: Strong expat community and English acceptance

Disadvantages:

- Bureaucratic complexity: Portuguese administration can be slow and complex

- Language barrier: Portuguese required for citizenship and many services

- Processing time: 60-90 days is longer than Spain’s timeline

- Tax residency implications: Becoming Portuguese tax resident affects global income

- Limited flexibility: Requires maintaining Portuguese address and presence

Real nomad experience: “The D7 visa changed my life, but the bureaucracy nearly broke me. Between SEF appointments, banking requirements, and tax registration, I spent my first month in Lisbon in government offices instead of cafés. Budget extra time and patience—it’s worth it long-term.”

– Marcus Chen, Software Developer, 3 years in Portugal

The Spain Digital Nomad Visa: A Full Breakdown

Spain launched its digital nomad visa program in January 2023, positioning itself as a premium destination for high-earning remote professionals. With faster processing and attractive tax incentives, it’s designed for nomads who can meet higher income requirements.

Requirements & Documents

Financial Requirements: The Spain digital nomad visa income threshold is significantly higher than Portugal’s: €2,160 per month (approximately $2,350 USD). This income must come from:

- Remote employment with non-Spanish companies

- Freelance work with international clients

- Business ownership (must be registered outside Spain)

- Investment income or dividends

- Combination of qualifying income sources

Key restriction: At least 80% of income must come from clients/employers outside Spain.

Essential Documents:

- Valid passport (6+ months remaining)

- Criminal background check (apostilled)

- Health insurance (public or private)

- Proof of accommodation in Spain

- Bank statements (3-6 months)

- Employment contracts or client agreements

- University degree or professional experience proof

- Proof of sufficient funds (€27,000+ recommended)

- Tax residency documentation

Application Process Step-by-Step

Phase 1: Eligibility Verification (2-3 weeks)

- Confirm income meets €2,160/month threshold

- Verify 80% of income comes from non-Spanish sources

- Gather required documentation

- Secure Spanish accommodation proof

- Obtain comprehensive health insurance

Phase 2: Online Application (1-2 weeks)

- Complete online application portal

- Upload all required documents

- Pay €80 application fee

- Submit application for review

- Receive confirmation and reference number

Phase 3: Processing & Decision (20-45 days)

- Immigration authorities review application

- Additional documentation requested if needed

- Interview may be required (rare)

- Approval or denial notification

- Visa collection at Spanish consulate

Phase 4: Spain Registration (90 days after arrival)

- Apply for foreigner identity number (NIE)

- Register with local police (empadronamiento)

- Open Spanish bank account

- Register for Spanish tax obligations

- Begin establishing Spanish residency

Pros & Cons

Advantages:

- Fast processing: 20-45 days vs. Portugal’s 60-90 days

- Beckham Rule eligibility: 24% flat tax rate for qualifying individuals

- Major tech hubs: Access to Madrid, Barcelona startup ecosystems

- Cultural richness: World-class museums, cuisine, and lifestyle

- Strong infrastructure: Excellent internet, transportation, and facilities

- Renewable duration: Up to 5 years with proper renewals

Disadvantages:

- High income requirement: €2,160/month excludes many nomads

- Strict client restrictions: 80% non-Spanish income requirement

- Tax complexity: Spanish tax system is notoriously complex

- Higher living costs: Major cities like Madrid/Barcelona are expensive

- Recent program: Limited long-term data on renewals and citizenship

Real nomad experience: “The Spain visa process was surprisingly smooth—approved in 28 days. But the tax implications hit me later. Spanish tax residency triggered obligations I wasn’t prepared for. Get professional tax advice before applying, not after approval.” – Jennifer Walsh, Marketing Consultant, 1 year in Barcelona

Key Differences: Taxes and Path to EU Residency

Understanding the tax and residency implications is crucial for making the right long-term decision.

Tax Implications Comparison

Portugal’s NHR Program: Portugal’s Non-Habitual Resident (NHR) program offers significant tax advantages for new residents:

- Foreign-sourced income: 0% Portuguese tax if taxed in source country

- Portuguese-sourced income: 10% flat rate for qualifying professions

- Investment income: Favorable treatment for dividends and capital gains

- Duration: 10-year program eligibility

- Qualification: Must not have been Portuguese tax resident in previous 5 years

Qualifying professions for 10% rate:

- Software developers and IT professionals

- Engineers and architects

- Medical professionals

- Artists and creative professionals

- Consultants and advisors

Spain’s Beckham Rule: Spain’s special tax regime for new residents offers:

- 24% flat tax rate on Spanish income up to €600,000

- Foreign income: Generally not taxed in Spain if source-country tax paid

- Duration: 6-year maximum program

- Qualification: Must not have been Spanish tax resident in previous 10 years

- High earner focus: Most beneficial for income above €150,000 annually

Residency and Citizenship Pathways

Portugal Citizenship Timeline:

- Year 1: D7 visa holder

- Year 2: Renew residence permit

- Years 3-5: Maintain residence and tax status

- Year 6: Eligible for Portuguese citizenship

- Requirements: A2 Portuguese language, clean criminal record, integration proof

Spain Citizenship Timeline:

- Year 1: Digital nomad visa holder

- Years 2-5: Renew nomad visa or convert to residence

- Year 6-10: Permanent residence status

- Year 11: Eligible for Spanish citizenship

- Requirements: A2 Spanish language, integration exam, clean record

Key consideration: Portugal offers faster citizenship (6 vs. 10+ years), while Spain provides more flexible visa renewal options.

EU Benefits Comparison

Both visas provide full Schengen Area access, meaning you can live and work freely in 27 EU countries. However, there are subtle differences:

Portugal advantages:

- Stronger passport (6th globally in Henley Index)

- EU citizenship in 6 years vs. Spain’s 10+

- More established expat integration programs

Spain advantages:

- Larger economy with more business opportunities

- Strategic location for Latin America business

- Major global cities (Madrid, Barcelona)

The Verdict: Which Visa is Right for You?

After analyzing income requirements, tax implications, and long-term benefits, here’s our recommendation framework based on different nomad profiles:

Choose Portugal’s D7 Visa If You:

The Budget-Conscious Builder (Income: €635-€2,000/month)

- Are building your remote income and need lower barriers

- Prioritize long-term EU citizenship (6-year pathway)

- Want significant tax advantages through NHR program

- Prefer slower pace of life and lower living costs

- Can handle Portuguese bureaucracy and language learning

Real example: Sarah, a freelance content writer earning €1,200/month, chose Portugal. The NHR program reduced her tax burden from 35% to 10%, and she’s on track for EU citizenship by 2030.

Choose Spain’s Digital Nomad Visa If You:

The High-Earning Hustler (Income: €2,160+/month)

- Earn well above Spain’s income threshold consistently

- Want fast visa processing (20-45 days vs. 60-90)

- Need access to major European tech/business hubs

- Can benefit from Beckham Rule tax advantages

- Prefer established startup ecosystems and networking

Real example: Marcus, a software consultant earning €4,000/month, chose Spain. The Beckham Rule capped his tax rate at 24%, and Barcelona’s tech scene doubled his client network.

Special Considerations:

For Families: Both visas include family members, but consider:

- Portugal: Lower income requirements make family inclusion easier

- Spain: Better international schools in major cities

For Entrepreneurs:

- Portugal: More favorable for location-independent businesses

- Spain: Better for scaling European operations

For Long-term EU Goals:

- Portugal: Faster citizenship pathway (6 vs. 10+ years)

- Spain: More flexible visa renewal options

Our Final Recommendation Matrix:

Your Profile | Best Choice | Key Reason |

|---|---|---|

Income €635-€1,500/month | Portugal D7 | Lower barrier, NHR tax benefits |

Income €2,160-€4,000/month | Spain or Portugal | Depends on tax optimization goals |

Income €4,000+/month | Spain | Beckham Rule maximizes benefits |

Citizenship priority | Portugal | 6-year vs. 10+ year pathway |

Business/networking focus | Spain | Major European business hubs |

Lifestyle/cost priority | Portugal | Lower costs, relaxed pace |

Bali is another popular destination for new nomads. Read how one nomad moved there in just 6 months in our Bali Case Study.

Next Steps: Making Your Decision

Before applying to either program:

- Calculate your true monthly income (average over 6-12 months)

- Model tax implications with a professional (both countries)

- Visit both countries for 2-4 weeks if possible

- Connect with expat communities in target cities

- Prepare financial runway (€15,000+ recommended for either)

Essential resources:

For Portugal D7 applications, visit the official SEF immigration portal for the most current requirements and processing updates.

For Spain’s digital nomad visa, check the official immigration website for application procedures and document requirements.

Pro tip: Consider the “test drive” approach. Apply for the visa that matches your current situation, then evaluate switching programs after 2-3 years based on your evolved income and goals.

The best digital nomad visa Europe offers isn’t one-size-fits-all—it’s the one that aligns with your income, goals, and lifestyle priorities. Both Portugal and Spain offer incredible opportunities for building your European nomad life.

For comprehensive preparation beyond just visas, check out our complete planning guide: The 2026 Digital Nomad Guide: Your Roadmap to Freedom for everything from financial planning to productivity systems.

Your European adventure starts with making this choice. Choose wisely, prepare thoroughly, and welcome to the EU nomad life.

Frequently Asked Questions

Can I switch from Portugal D7 to Spain’s nomad visa (or vice versa)?

Yes, but it’s not a direct transfer. You would typically complete your initial visa period, return home, and apply for the new program. It’s a strategy some nomads use to optimize their situation after a few years.

Which visa is easier to renew long-term?

Spain allows renewals up to 5 years with proper documentation. Portugal’s D7 converts to a standard residence permit after the initial period, often providing more long-term stability.

Do I need to speak Portuguese or Spanish to get these visas?

No language requirement for initial approval. Both countries require A2-level proficiency only for eventual citizenship applications.

Can I work for local companies with these visas?

Portugal’s D7 allows some local work after residence conversion. Spain’s nomad visa restricts local employment—you must maintain 80% foreign income.

What happens if my income drops below the requirement?

This affects renewals. Portugal’s €635 threshold provides more flexibility than Spain’s €2,160 requirement for income volatility.

Digital Nomad Visas: Portugal vs. Spain Comparison

The Portugal D7 Visa

Known as the gold standard for European nomad visas, it offers one of the lowest income requirements in Europe (€635/month) and a clear 6-year pathway to EU citizenship.

Best for budget-conscious nomads and those prioritizing a faster path to EU citizenship, offering significant tax advantages through the NHR program.

Editor's Rating:

Visit Website

The Spain Digital Nomad Visa

A premium option for higher-earning remote professionals, featuring a faster application process (20-45 days) and attractive tax incentives like the 'Beckham Rule'.

Best for high-earning nomads who want fast visa processing and access to major tech hubs like Madrid and Barcelona, with tax benefits from the 'Beckham Rule'.