⚠️ IMPORTANT DISCLAIMER ⚠️

I am not a tax professional. This guide is for informational purposes only. Please consult a qualified CPA or tax advisor for advice specific to your situation. Tax laws change frequently, and individual circumstances vary significantly.

Starting a side hustle is exciting—until someone mentions taxes. Suddenly, you’re spiraling down a rabbit hole of forms, deductions, and quarterly payments that seem designed to confuse rather than clarify.

Here’s the truth: side hustle taxes aren’t as complicated as the internet makes them seem. Yes, there are new responsibilities when you start earning money independently, but understanding the basics will keep you compliant, save you money, and eliminate the anxiety that stops many people from pursuing their entrepreneurial dreams.

When Sarah in our VA Case Study earned her first $1,000, these are the exact tax rules she had to learn and follow. This guide breaks down everything you need to know about side hustle taxes in 2025, from the moment you earn your first dollar to filing your annual return.

The goal isn’t to turn you into a tax expert—it’s to give you enough knowledge to make informed decisions and know when to seek professional help. By the end of this guide, you’ll understand your basic tax obligations and have a clear system for staying compliant while maximizing your deductions.

In this guide, you will learn:

- When you’re officially required to pay taxes (the $400 rule)

- What self-employment tax is and how it’s calculated

- The most common deductions you can claim to lower your tax bill

- How to handle quarterly estimated tax payments and deadlines

- The key tax forms you’ll need to know (Schedule C & SE)

The Big Shift: You’re a Business Owner Now

The moment you start earning money from your side hustle, your relationship with taxes fundamentally changes. As an employee, your employer handles most tax responsibilities: withholding income taxes, paying their share of Social Security and Medicare, and sending you a W-2 at year-end that makes filing relatively straightforward.

When you’re self-employed—even part-time—you become responsible for both sides of this equation. You’re now both the employee and the employer, which means you handle your own tax withholding and pay both the employee and employer portions of Social Security and Medicare taxes.

This shift explains why self-employed individuals often owe money at tax time while employees typically receive refunds. It’s not that the tax system is punishing entrepreneurs—it’s that nobody has been withholding taxes from your side hustle income throughout the year.

Understanding this fundamental difference is crucial because it affects how much you should save, when you need to make payments, and what forms you’ll file. The good news? Once you understand the system, managing these responsibilities becomes routine rather than overwhelming.

The IRS treats your side hustle as a business regardless of whether you’ve filed formal paperwork or chosen a business structure. From their perspective, if you’re providing services or selling products with the intent to make a profit, you’re operating a business and subject to business tax rules.

The Key Questions Answered

When Do I Need to Worry About Taxes? (The $400 Rule)

The magic number for side hustle taxes is $400. If your net earnings from self-employment (total income minus business expenses) reach $400 or more in a tax year, you’re required to file a tax return and pay self-employment tax, regardless of your total income from all sources.

This $400 threshold applies to your profit, not your gross revenue. For example, if you earned $1,200 from freelance writing but spent $800 on legitimate business expenses (computer, software, office supplies), your net earnings would be $400—exactly at the threshold where tax obligations begin.

It’s important to note that this rule applies even if you’re already employed full-time and receiving a W-2. Your side hustle income is treated separately, and reaching $400 in net self-employment earnings triggers additional tax responsibilities beyond what your regular employer withholds.

Many new side hustlers make the mistake of thinking they can ignore taxes until they reach significant income levels. The reality is that tax obligations begin much sooner than most people expect, and the penalties for non-compliance can be substantial relative to small income amounts.

If your net self-employment earnings are under $400, you’re not required to pay self-employment tax, but you may still owe regular income tax on the earnings depending on your total income from all sources. When in doubt, it’s better to track everything and consult a professional than to assume you’re below reporting thresholds.

What is Self-Employment Tax? (A Simple Explanation)

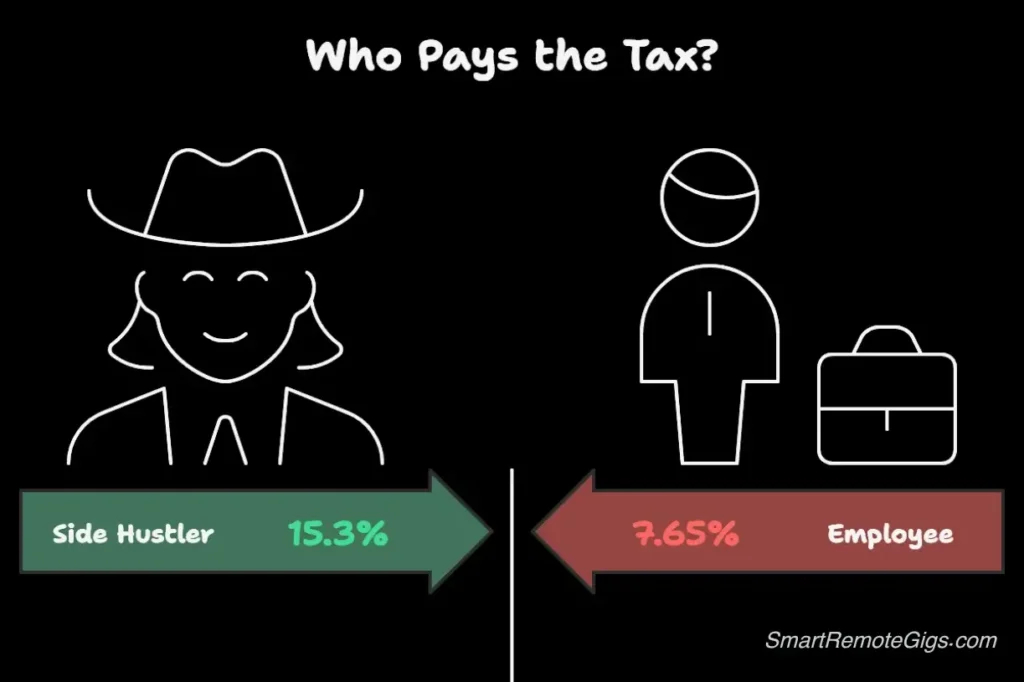

Self-employment tax is essentially Social Security and Medicare tax for people who work for themselves. When you’re an employee, you pay 7.65% of your wages for Social Security and Medicare, and your employer matches that with another 7.65%, totaling 15.3% going to these programs.

As a self-employed individual, you pay both portions—the full 15.3%. This breaks down to 12.4% for Social Security (on earnings up to $176,100 in 2025) and 2.9% for Medicare (on all earnings, with an additional 0.9% on high earners).

Before you panic about paying “double” the tax, remember that you get to deduct half of your self-employment tax as a business expense, which partially offsets the additional burden. Additionally, this tax is building your credits toward Social Security and Medicare benefits in retirement.

Self-employment tax is calculated on your net earnings from self-employment—your business income minus legitimate business expenses. This is why tracking expenses is so crucial; every dollar in legitimate business expenses reduces both your income tax and self-employment tax obligations.

The self-employment tax is in addition to regular income tax on your side hustle earnings. Many new entrepreneurs are surprised by this “double taxation,” but understanding it upfront allows you to plan accordingly and save the appropriate amount throughout the year.

What is a 1099-NEC and What Do I Do With It?

A 1099-NEC (Nonemployee Compensation) is a tax form that clients use to report payments made to independent contractors. If you received $600 or more from a single client during the tax year, they’re required to send you a 1099-NEC by January 31st and file a copy with the IRS.

The key word here is “required”—but many clients don’t comply with this requirement, especially smaller businesses or individuals who aren’t familiar with tax obligations. The absence of a 1099-NEC doesn’t mean you don’t owe taxes on the income; you’re still responsible for reporting all self-employment income regardless of whether you receive the proper forms.

When you do receive 1099-NEC forms, review them carefully for accuracy. The amount shown should match your records of payments received from that client. If there are discrepancies, contact the client immediately to request a corrected form, as the IRS will expect your tax return to match the 1099s they have on file.

You don’t need to attach 1099-NEC forms to your tax return when filing electronically, but keep them with your tax records. The information from these forms gets reported on Schedule C (Profit or Loss from Business), where you’ll list your total business income from all sources, whether or not you received 1099s.

Some side hustlers worry about clients who pay cash or through platforms that don’t issue 1099s. Remember: all income is taxable regardless of how you received it or whether it’s formally documented. Maintaining detailed records of all earnings protects you in case of an audit and ensures you’re meeting your legal obligations.

Your #1 Job: Track Everything

The foundation of successful side hustle tax management is meticulous record-keeping. This means tracking every dollar that comes in (income) and every dollar that goes out for business purposes (expenses). The IRS requires you to maintain records that substantiate the income and deductions you claim on your tax return.

For income tracking, record the date, amount, client or source, and payment method for every payment you receive. Don’t rely on memory or informal notes—use a dedicated system whether that’s a spreadsheet, accounting software like Wave (mentioned in our [10 Free Tools guide]), or a simple notebook. The key is consistency and completeness.

Expense tracking is equally important because legitimate business expenses reduce your taxable income dollar-for-dollar. Save receipts for everything business-related, no matter how small. That $3 parking meter fee for a client meeting or $15 for business cards can add up to significant tax savings over the course of a year.

Modern technology makes tracking easier than ever. Use your phone to photograph receipts immediately, set up a dedicated business bank account to separate personal and business expenses, and consider using apps that automatically categorize expenses and mileage.

The IRS generally requires you to keep business records for at least three years after filing your return, though some circumstances may require longer retention. Develop a system for organizing receipts and documents that you can maintain long-term without becoming overwhelming.

Remember that good record-keeping isn’t just about tax compliance—it’s about understanding your business profitability and making informed decisions about pricing, expenses, and growth opportunities. The time you invest in tracking pays dividends beyond just tax season.

Common Tax Deductions to Lower Your Bill

Tax deductions reduce your taxable income, which directly lowers the amount you owe in both income tax and self-employment tax. Understanding common deductions helps you identify legitimate business expenses and maintain proper documentation throughout the year.

A business deduction must be both “ordinary and necessary” for your type of business. Ordinary means it’s common and accepted in your industry, while necessary means it’s helpful and appropriate for your business, though not necessarily indispensable.

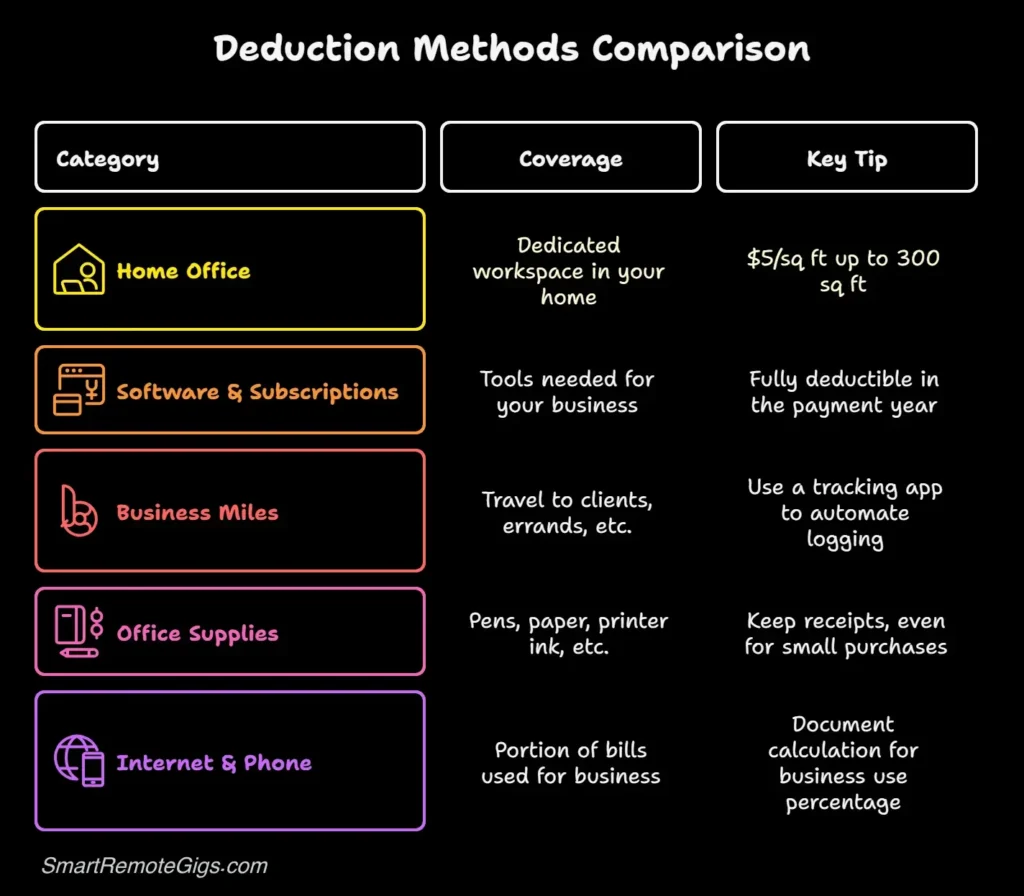

Home Office Deduction (The Simple Method)

If you use part of your home regularly and exclusively for business, you may qualify for the home office deduction. The simplified method allows you to deduct $5 per square foot of your home office, up to 300 square feet, for a maximum deduction of $1,500.

To qualify, the space must be used exclusively for business—not your kitchen table where you sometimes work, but a dedicated area used only for your side hustle. Regular use means you use this space for business on a regular basis, not just occasionally.

The simplified method is easier to calculate and requires less documentation than the actual expense method, making it ideal for most side hustlers. You simply measure your office space, multiply by $5, and claim the deduction without tracking utilities, mortgage interest, or depreciation.

Software and Subscriptions

Business software subscriptions are fully deductible in the year you pay for them. This includes accounting software, design programs, project management tools, email marketing services, and any other software necessary for your business operations.

Keep records of what each subscription is used for and how it relates to your business. Generic descriptions like “software” won’t suffice if questioned—be specific about whether it’s for project management, client communication, or content creation.

Don’t forget about smaller subscriptions that might slip through the cracks: stock photo sites, online learning platforms for professional development, or specialized apps for your industry. These seemingly minor expenses can add up to substantial deductions.

Business Miles

Transportation expenses for business purposes are deductible, and the IRS provides a standard mileage rate that changes annually. For 2025, track your business miles and multiply by the current IRS rate to determine your deduction.

Business miles include travel to client meetings, networking events, business-related errands (like trips to the post office to mail client packages), and travel between multiple business locations in the same day. Commuting from your home to your regular place of work is not deductible.

Maintain a mileage log that records the date, destination, purpose, and miles driven for each business trip. Many apps can automate this tracking using your phone’s GPS, making compliance much easier than manual logs.

Office Supplies

Pens, paper, printer ink, business cards, folders, and other office supplies used exclusively for business are fully deductible. Keep receipts and maintain records of what you purchased and how it relates to your business operations.

For supplies that serve dual purposes (like a computer used for both business and personal use), you can only deduct the percentage used for business. Be prepared to substantiate these percentages with usage logs or other documentation.

Consider timing your office supply purchases strategically—if you need supplies early in the following year, purchasing them in December can provide deductions in the current tax year while meeting your actual business needs.

Internet and Phone Bills (% of Use)

If you use your personal internet connection or phone for business, you can deduct the percentage used for business purposes. This requires you to estimate and document what percentage of your usage is business-related versus personal.

For example, if you estimate that 30% of your home internet usage is for business, you can deduct 30% of your annual internet bills. Keep records of your calculation method and be prepared to explain your reasoning if questioned.

The same principle applies to phone bills if you use your personal phone for business calls. Consider getting a separate business line if the percentage becomes difficult to calculate or if you want cleaner record-keeping.

How to Pay: Understanding Quarterly Estimated Taxes

Unlike employees who have taxes withheld from each paycheck, self-employed individuals must make estimated tax payments throughout the year. These quarterly payments cover both income tax and self-employment tax on your expected annual earnings.

The IRS expects you to pay taxes as you earn income, not just once a year at filing time. If you owe $1,000 or more in taxes when you file your return, you may be subject to penalties for underpayment of estimated taxes, even if you pay the full amount by the filing deadline.

The Four Key Deadlines

Quarterly estimated taxes are due four times per year, but the quarters aren’t equal three-month periods. Mark these dates on your calendar and set reminders well in advance:

- April 15, 2025 (for January-March 2025 income)

- June 16, 2025 (for April-May 2025 income)

- September 15, 2025 (for June-August 2025 income)

- January 15, 2026 (for September-December 2025 income)

Notice that the second quarter is only two months, while the third quarter is three months. These irregular periods can trip up new business owners who assume each payment covers exactly three months of earnings.

How Much to Pay

The safest approach for estimated taxes is the “safe harbor” rule: if you pay 100% of last year’s total tax liability (110% if your prior year adjusted gross income exceeded $150,000), you won’t owe penalties regardless of how much you owe when you file.

For new side hustlers without prior year self-employment income, estimate your expected annual profit and calculate 25-30% for federal taxes (this covers income tax and self-employment tax). Add state taxes if applicable to your situation.

Many tax professionals recommend saving 25-30% of every side hustle payment in a separate account dedicated to taxes. This creates a consistent habit and ensures funds are available when quarterly payments are due.

The Forms You’ll Meet: A Quick Introduction

Schedule C: Profit or Loss from Business

Schedule C is where you report your side hustle income and expenses. This form calculates your net profit (or loss), which flows to your main tax return (Form 1040) and is used to calculate your self-employment tax.

The form is relatively straightforward: you list your business income, subtract your business expenses, and arrive at your net profit. This net profit becomes part of your adjusted gross income and is subject to both income tax and self-employment tax.

You’ll need a separate Schedule C for each business you operate. If you have both a freelance writing business and sell handmade crafts online, each would require its own Schedule C with separate income and expense tracking.

Common mistakes on Schedule C include mixing personal and business expenses, inadequate documentation for claimed deductions, and failing to report all income (particularly cash payments or income without 1099s). Careful record-keeping throughout the year prevents these issues.

Schedule SE: Self-Employment Tax

Schedule SE calculates your self-employment tax based on your net earnings from Schedule C. The form applies the 15.3% self-employment tax rate to your net business income, with adjustments for the Social Security wage base limit.

The calculation includes a deduction for half of your self-employment tax, which partially offsets the “double” tax burden of paying both employee and employer portions. This deduction is taken on your main tax return, not on Schedule SE itself.

If you have multiple businesses or sources of self-employment income, you’ll combine the net earnings from all sources on Schedule SE. The self-employment tax is calculated on your total net self-employment earnings, not separately for each business.

Conclusion: Don’t Panic, Just Plan

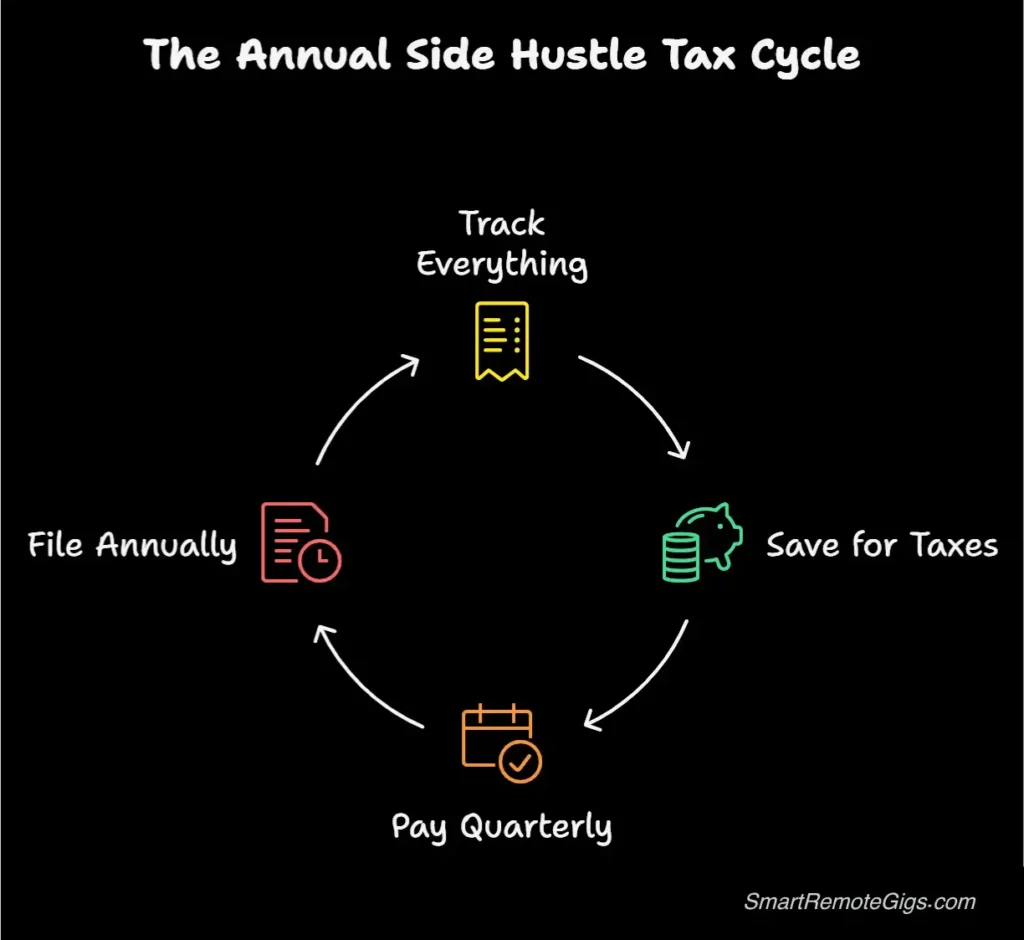

Side hustle taxes don’t have to be overwhelming if you understand the basics and maintain good habits throughout the year. The key principles are simple: track everything, save consistently for taxes, understand your quarterly payment obligations, and know when to seek professional help.

Start with basic record-keeping from your very first side hustle dollar. Use simple tools like spreadsheets or free accounting software to track income and expenses. Save 25-30% of every payment in a dedicated tax account. Make quarterly estimated payments if you expect to owe $1,000 or more annually.

Remember that these tax obligations come with benefits: you’re building Social Security credits for retirement, many business expenses are deductible, and you have more control over your tax timing and planning than traditional employees.

The most expensive mistake is avoiding the topic entirely. Small oversights in the first year can compound into significant problems later. Start simple, stay consistent, and upgrade your systems as your side hustle grows.

Most importantly: consult with a qualified tax professional if you have questions about your specific situation. The cost of professional advice is almost always less than the cost of mistakes, penalties, or missed opportunities.

Now that you understand the tax fundamentals, you’re ready to focus on the income side of the equation. Get the complete strategy for building a profitable side hustle in our Ultimate Side Hustle Guide: From Idea to First $1,000, where you’ll learn exactly how to find clients, price your services, and scale your business using the 10 free tools that handle everything from project management to getting paid.

Ready to start earning? The tax knowledge you now have removes one of the biggest barriers between you and side hustle success. Your future self will thank you for understanding these basics before you needed them.

Have specific tax questions about your situation? This guide covers the fundamentals, but every side hustle is unique. Consider consulting with a qualified tax professional who can provide advice tailored to your specific circumstances and help you optimize your tax strategy as your business grows.